Is data an asset? This is not a straightforward question.

‘Can a value for intangible assets be included on the balance sheet?’ – is more straight forward, – the answer according to Generally Agreed Accounting Rules (GAAP) -at least at time of writing – is no.

But many argue that we should treat data as if it were an asset.

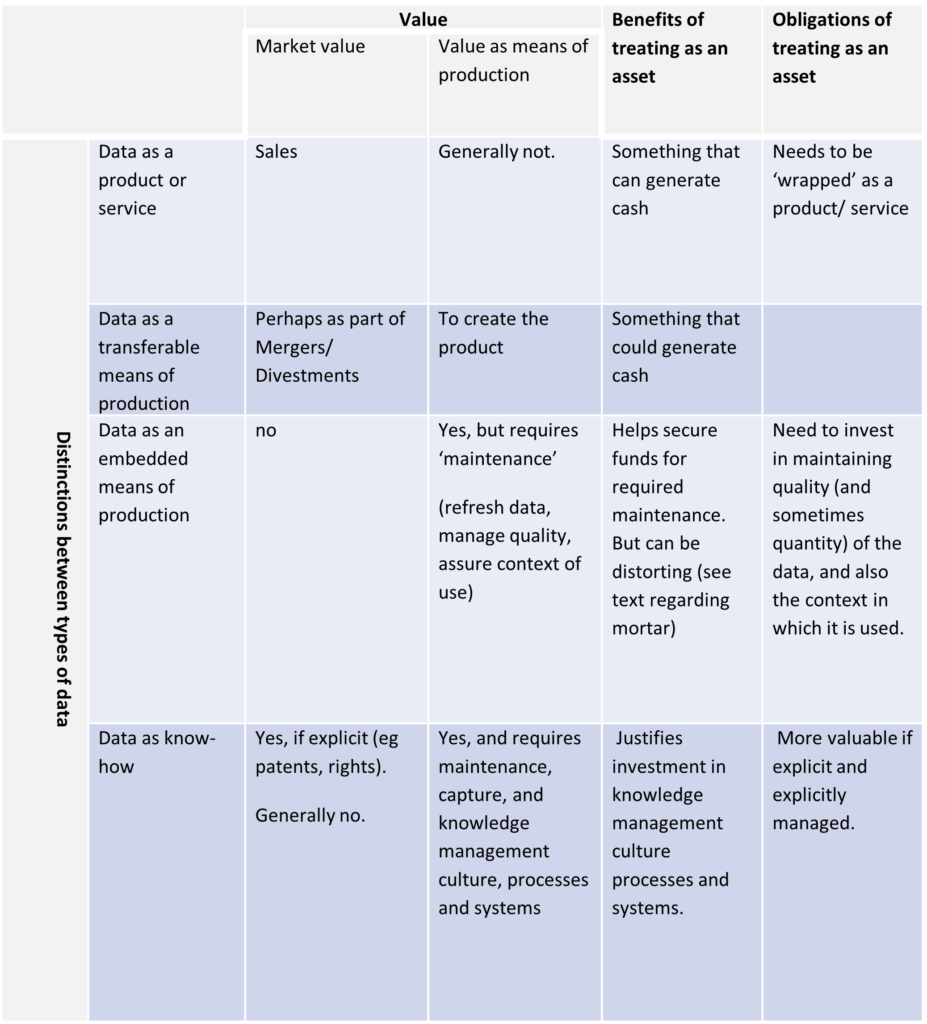

Following the principle of distinctions before labels, lets look at two relevant distinctions – what we might mean by asset and what we might mean by data.

What makes something an asset?

Lets start by looking at value – First – something that has a value to others; second – something that can generate value for ourselves. The goose that lays the golden eggs would undoubtedly have value to others, but its ongoing ability to generate eggs for us may makes it valuable for us to keep.

Doug Neal, a former colleague, for the first case used the definition ‘an asset is something you can sell to make payroll’. It is also something that if the company folded could be sold to pay stockholders, creditors etc. This requires that there be a reasonably liquid market for the prospective asset.

But assets are not just about value – there are obligations that come with assets, and also risks. Assets (particularly those associated with generation of value) tend to require maintenance and investment. It is primarily around this management obligation that considering data as an asset is most helpful.

What forms of data might be asset-like?

There is too broad a range of data to be able to meaningfully make distinctions in just one chapter, but there are some use cases that can be distinguished and illustrated.

Data as a product (or service): Here the data (or rights to access the data) is the essence of the product. This might include a weather forecast, a railway timetable or a streamed music track.

Data as part of the means of production (tradable): This might include datasets used to predict the weather, or historical accident data to determine insurance premiums. These are primarily used internally to generate value, but could potentially be used by others to generate value

Data as an embedded part of the means of production: This might include parameters for optimal production in an industrial complex under different scenarios[1]. These have great value internally, but are context specific and may have little direct, immediate value to others.

Other intellectual property and know-how: This is a broad category and may include things that are explicit (eg patents) or implicit (general experience of operatives).

Risks of treating data as an asset.

- More is not always better.

Usually for assets the more you have, the more value you have. Data can also be a liability. There can be an obligation to analyse and make data available as part of a legal case. Such discovery exercises are routine in some industries (such as pharmaceuticals). Even when everything is 100% in order, legal assessment of large amounts of data incurs considerable expense. There is the additional risk that some of the retained data might contain unresolved issues which might be used to cast doubt on an otherwise proper situation. For this reason some companies actively limit the amount of stored data.

- Data might not be the proper focus.

Consider a traditional bricks and mortar factory. Over time, the mortar will need maintenance. The work will need to be paid for from a budget. It needs to be under the overall asset management capabilities of the firm. The mortar is rightfully considered as an asset that needs to be maintained. It is essential, but in a sense it is also incidental. We would not expect to see a book entitled ‘treat mortar as an asset’ – its just one of many essential parts of maintaining the means of production. An undue focus on mortar would be unhealthy, and trying to monetise the mortar independently of the rest of the functioning of the factory would be unwise.

The focus on data might reduce the proper consideration of overall systems, processes, controls, culture and measures of success. Something definitely needs to be managed as an asset – but it’s a broader and more holistic concept than “data”.

The primary benefit of treating data as an asset is to ensure there is management attention on maintaining it (for example, covering currency, accuracy and completeness).

The primary benefit of trying to attribute a value to the data is to justify the necessary costs of managing the data.

A focus on ‘data’ as being an asset risks underplaying the significance of the broader context and processes. In many cases ‘data’ is no more a valuable asset than mortar is to a physical factory. Essential, requiring maintenance, but not worth much without the bricks.

[1] For example, historical records of yield from a chemical process under different conditions of temperature, pressure, catalysts and mx of ingredients.